Online Banking

Member Sign In

Are you a new member? Register here!

Are you a new member? Register here!

Life is mobile. So is Smart Financial.

Banking technology has made things like checking balances and paying loans easier and more streamlined than ever. Our digital banking solutions save you time and hassle no matter how busy life gets. Bank on your own time, not ours.

MOBILE APP & ONLINE BANKING

Simple. Streamlined. Secure.

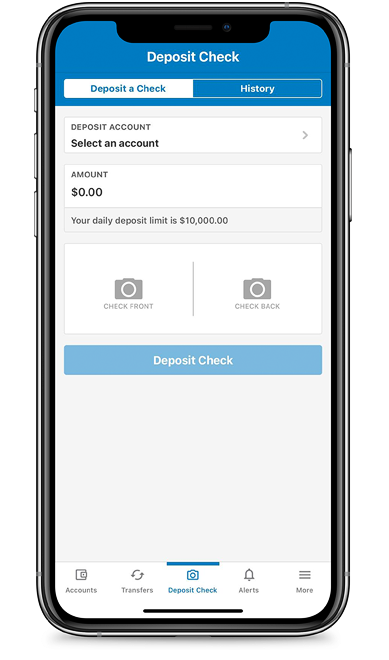

mobile check deposit

balances without login

budget tracking

savings goals

pay bills

anytime loan payments

account history

access other bank accounts

customized alerts

Quicken Web Connect

Mobile App

A mobile version of online banking with these additional features:

set up budgets

download your statements

view analytics on your loans

Download our mobile app to enroll on your iPhone or Android device.*

App Store Google PlayMobile Deposit

Securely deposit checks using the camera on your smart phone.*

deposit checks in 5 simple steps

super easy - app walks you through it

deposit checks to checking and savings

Download our mobile app to enroll on your iPhone or Android device.*

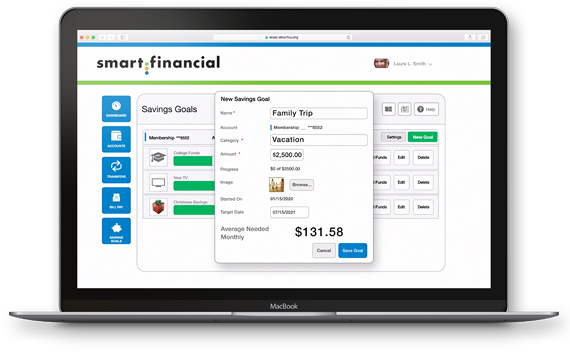

Savings Goals

Save for college, a family trip, a renovation, or anything at all. Enjoy watching your savings grow!

set multiple savings goals

track progress & set target dates

link your goals with your savings account balances

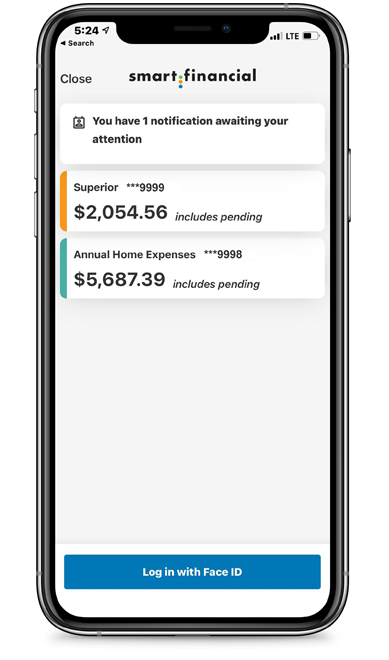

Snapshot

View balances and recent activity on the go.

no log in required

view your accounts with one tap

customize Snapshot in Settings

perfect smart watch companion

Balance snapshot only available on our mobile app.

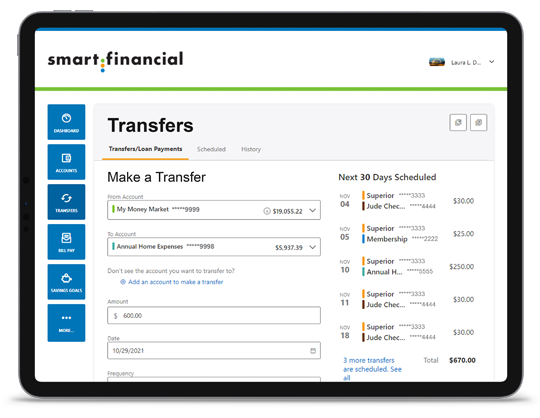

Simple Transfers

Transfer between accounts in seconds.

move funds between accounts

anytime loan payments

link accounts to your other banks

monitor & send cash to your teen*

Balance snapshot only available on mobile app using below devices.

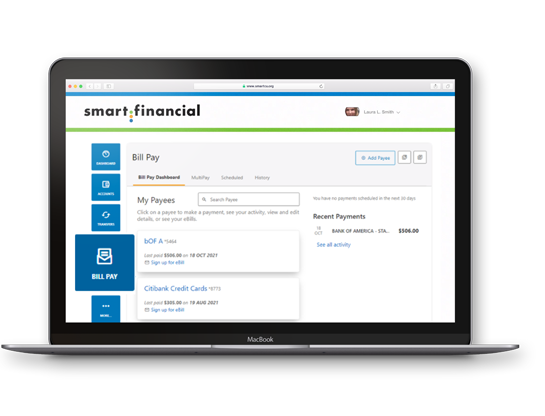

Bill Pay

Pay all of your bills from one place.

pay any business or individual

check or electronic payments*

never miss a payment with eBills

send recurring or one-time payments

Tip: Add the Bill Pay widget to your dashboard in Settings for quick access!

Mobile App Reviews

Saves time! I just get on this app to transfer money to another account and then I’m done! No need to drive to the bank when I can do it online.

Ease of use. My husband and I are educators and have use SFCU for many years. We enjoy the ease of use with all the online functions. It s not often, but when I do go into an office the service is seamless and professional.

Convenience. I love the fact that I can check my accounts 24/7 on my mobile device. All my banking is at my finger tips.

Banking in my hand. No delays. Convenient. User friendly. Easy access to savings, checking, loan(s), debit card use, credit card use, Bill pay—never need to leave home. I’m lovin’ it!

Transferring money between checking and saving is just a few taps with no hassle, and I get to sign in with just my fingerprint so, no time's wasted when I want to see the deal with my money.

It's the best banking app on the market, I've been a customer for years and when they came out with is app it made online banking less stressful...they are working hard to keep me protected, but first and foremost, it's user friendly.